Uganda's Coffee Value Chain

Uganda

Agriculture, Food and beverages

Market Insight: industry

Last update: Aug 7, 2020

Coffee is Uganda’s leading export commodity, representing over 10% of the value of goods sold abroad and earning the country $494 million in the 2019/2020 financial year, marking an 18.25% increase from 2018/2019. The major coffee varieties, Robusta and Arabica, are grown in the ratio 4:1, which sets Uganda apart from the region’s other major coffee growers, Kenya, Ethiopia and Tanzania, which grow mainly Arabica beans. Arabica beans are suitable for high altitudes which are not common in the country, while Robusta grows at altitudes ranging from 900 metres to 1500 metres, the ideal topography for the country’s coffee growing areas. Robusta is best used as a blend or in soluble coffee, meaning Uganda largely caters to a different market than its neighbours. The former tends to fetch lower prices than coffee that can be sold as signal origin, while the latter requires processing capabilities that are not currently available domestically. Instead, a significant amount of Ugandan Robusta is exported to Tanzania for processing at the Bukoba processing plant. According to market research, the global market for soluble or instant coffee is forecast to grow at a CAGR of 5% between 2017 and 2022, offering an opportunity for Uganda growers and processors to tap into revenues from value addition.

At the other end of the market, Uganda has been encouraging more sales of high-end coffee. One initiative on this front has been the establishment of an online auction in early 2018 by the Uganda Coffee Development Authority and African Fine Coffee Association to trade specialty coffee. This follows on from a promotional campaign initiated in 2016 to advertise the country’s single-origin coffee in various markets, particularly the US. As a result of this initiative, several brands such as Good African Coffee and Endiro Coffee have begun exclusively producing single-origin coffee.

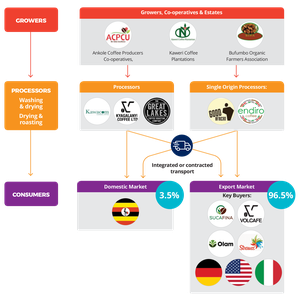

Value Chain

Unlike its neighbours, Uganda does not sell coffee via a centralised auction system. Instead, local companies are allowed to represent international traders and buy coffee on their behalf, while large coffee companies and cooperatives market their coffee directly to buyers. As a result of the direct links between growers, exporters and buyers the traceability of beans is better managed relative to other parts of East Africa. The lack of a centralized auction system in part strengthened coffee exports during the pandemic. Between March and May, most producing countries struggled to get their coffee to market since demand was depressed, however since Ugandan marketers have always had a direct relationship with their clients, they were able to recover faster than producers in neighbouring East African countries. The harvest also played an important role in the increase in export revenue since more crops fruited this year resulting in elevated production. Coffee exports rose by 21.05% from 4.16 million bags in 2018/19 to 5.06 million bags in 2019/20.

Trade

Trade is concentrated at the top of the market with the largest 10 exporters accounting for approximately 78% of the volume of coffee exports, with the top three holding nearly 39% of this. The top players control a slightly larger proportion of Robusta sales, which make up the majority of exports, at 86.3% of the total compared to 85.57% of Arabica beans, which are more likely to be sold as specialty coffee. Though the very largest players tend to maintain their pole positions, there is an element of dynamism within the market based on each firm’s ability to manage their coffee stock from their own farms or outgrower schemes. Uganda is the only country in Africa where coffee beans are available throughout the year, offering a unique proposition for buyers since supply is ensured throughout the year. However, climate change is making harvests more volatile, creating supply chain difficulties. Companies that can supply farmers with inputs that support yields reduce some of the risks associated with inconsistent output. Others work across the region to maintain a larger base of source markets.

Sector Structure

Asoko has profiled 33 active coffee exporters in a universe of 54 registered coffee exporters. Of the 33, the top 10 players command approximately 80% of the market in terms of quantity sold.

Expanding your footprint in Africa?

Making business decisions is hard to do in opaque and dynamic markets.Connecting with companies even harder. Our suite of data-driven and digital solutions can help you identify, verify and engage with African companies.

Coffee growers are widespread throughout the country, and especially in the Western region. Almost all leading exporters are based in Kampala, with only six players based elsewhere, operating out of Jinja, Mubende and Mbale. This is mostly due to the ease of managing export services from Kampala. The local coffee industry is better developed in the second half of the value chain, with little overall integration. Roughly half of the leading coffee players operate as processors and exporters while 15% cover the full value chain. The remaining firms operate a combination of growing, processing, transport and exporting activities. Of the leading coffee players in Uganda, eight have a regional presence, with operations either in Kenya or Tanzania, and a further firm has operations across the three countries.